The past 14 years have seen a major transformation of the Chinese hotel industry.

At the turn of the millennium, the US and Europe’s major brands had little more than a token presence in the country: Starwood had just seven properties and Accor only five.

But with the US market approaching saturation point and strong competition in Europe, the industry’s big hitters have piled into China. Accor has close to 200 properties in the country, and aside from North America, it is home to the most Starwood hotels of any nation in the world.

The cruise industry could well now be where the hotel sector was 14 years ago. Though the US remains by far the dominant country in terms of market share – it had more than 51% of global passengers in 2013, according to CLIA estimates – cruising’s traditional heartland is unable to sustain much more. With a guest growth rate of 15.1% from 2009-13, it had the second-slowest market expansion in the industry. Only Canada performed worse, with a creeping passenger increase of 1.3%.

In Europe, the situation is more positive. France’s passenger numbers rose by 68.0% over the same period, and Germany’s grew by 81.0%. Scandinavia and Finland, though with only 1.6% of the global passenger share, have seen a huge increase of 184.6%.

Yet, the European market also faces significant challenges. The burgeoning river cruise sector is central to its growth, but this has limited expansion potential given the relative lack of route choices and clusters of popular destinations that will quickly become crowded.

The economic recovery is also more sluggish than many expected, keeping money out of potential vacationers’ pockets. And the shadow of the 2012 Costa Concordia tragedy still lurks in the background.

Land of opportunity

By contrast, China is bursting with potential. The country’s burgeoning middle classes, hungry for Western travel experiences, offer an enormous new target market; last year, the Asia Cruise Association published a white paper estimating there would be 1.6 million Chinese passengers by 2020. There is also the added bonus that the Chinese Government is firmly on the industry’s side – Beijing’s latest five-year plan has decreed that cruising is to be encouraged, and more cruise terminals are on the way.

It is therefore no surprise that two of the industry’s largest players, Carnival and Royal Caribbean, have already made strong moves to establish themselves in the Chinese market. By next year, Carnival plans to have a total of four ships based on the mainland, including Costa’s flagship the Costa Serena. Not to be outdone, Royal Caribbean is to make Shanghai the home port of its latest star ship, Quantum of the Seas, having already sent Voyager of the Seas to the Chinese market in 2012 and Mariner of the Seas in 2013. The cruise line has also set up a staff training centre in north China’s port city of Tianjin.

"China is among our most profitable markets – it is already our third-largest market behind the US and the UK, and we believe it will grow even more," said Royal Caribbean president Adam Goldstein in a recent interview with Forbes.

"The number of Asians cruising today is very similar to the number of Americans who were cruising in the 1980s. No other market has comparable growth potential… The market size of Hong Kong and the adjacent Pearl River Delta region is estimated to be the same size as Singapore and the north China region combined."

But while both lines are keen to tap into China’s enormous potential, catering for this new market will not be easy. As Carnival Corporation’s CEO Arnold Donald pointed out in a conference call with reporters in May this year, "The vast majority of Chinese have no concept of cruising.

"In a way, that’s a good thing," he continued. "Here in the US and Europe, the people we’re dying to attract actually have opinions. They have impressions… they have lots of negative things in their mind. In China though, they have no concept of what a cruise is. You say cruise, and they say ‘What’s that?’"

Great lengths

Beyond this lack of awareness among China’s holidaymakers, Carnival and other cruise lines looking to break into the country must also cater for the various cultural nuances they will inevitably encounter. Chinese vacationers, for instance, tend to prefer short trips, requiring a rethink of the typical seven-night cruise often sold to the US market.

Faced with this issue in a recent interview with CNBC, Donald replied, "We have already adjusted, and we have a number of shorter, four-day cruises because of the shorter vacation times a lot of the Chinese public have.

"But, at the same time, we’re going to have our first world cruise – an 86-day cruise aboard one of the Costa ships. That’s going to be sold out… We are the first company to do a world cruise from a home port in mainland China.

"China has a lot of people, there’s a great range of demographics, and there are those people who have the time, the inclination and the wherewithal to take a longer cruise."

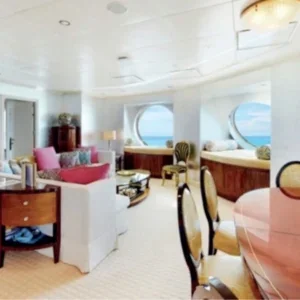

Beyond the length of the cruise itself, operators are also considering the on-board entertainment on offer. While Chinese passengers do want a Western experience, it must not feel overtly foreign or push passengers too far out of their comfort zone.

"They want to consume Western experiences, but, I would say, in a Chinese way," Goldstein explained in a recent interview with Bloomberg. "They’re interested in having Western culinary experiences, but we know they need to still have their Chinese comfort foods available to them on the ship.

"We’d also love for them to enjoy comedians and other entertainers, but they’re going to have to be Chinese comedians speaking in Chinese languages, not English comedians. And we know they want to shop like crazy; on board, in ports, everywhere – their passion for shopping has really struck us."

Donald expressed similar sentiments in his interview with CNBC, adding that gambling is particularly popular in Asian markets.

But while China is a highly attractive market for Royal Caribbean and Carnival, they must move quickly if they are to establish themselves securely enough for long-term success in the region.

Star Cruises – widely credited with developing the cruise industry in Asia-Pacific – is currently building two new vessels for a combined cost of €1.4 billion, specifically designed for the Asian market, while lesser-known local operators are also looking to muscle in on the action – Xiamen International Cruise Co is constructing China’s first major cruise vessel, costing approximately $485 million. It is scheduled for completion in October 2018.

More familiar with the Chinese holiday market and with vessels specifically built for Asian customers, such lines could offer an attractive alternative to Royal Caribbean and Carnival. In the years to come, competition for dominance in this burgeoning region will no doubt be fierce.