Carnival Cruise Line has been fielding the question ‘is bigger better?’ since 1996, when it launched Carnival Destiny, the first cruise liner to exceed 100,000t. 25 years later, its newest ship, the 5,200-passenger Mardi Gras, is almost twice as big, and alongside a plethora of restaurants and bars, houses a rollercoaster, BOLT, that sits on an 800ft track and can hit speeds of up to 40 miles per hour.

Clearly the global pandemic hasn’t dampened the company’s drive to answer its most-asked question. But in this case, says Ben Clement, senior vice president of newbuilds and refurbishments, it’s not her size that makes the Mardi Gras unique.

“Granted, larger ships provide our designers with an even greater canvas to create one-of-a-kind attractions, such as BOLT, but there’s so much more to a ship than just its size,” he says.

“If the spaces are not appealing to guests and not easy to navigate, it doesn’t matter what size the ship is. Mardi Gras is more than just our largest ship – it’s a testament to the incredible talent of our shipbuilding teams, who worked five years on designing a ship whose layout and amenities are game-changers for our company and industry.”

In a time of pandemic-induced downturn, however, it remains to be seen whether cruise lines are willing to continue this quest to build bigger and better.

Indeed, during the period of suspended operations caused by the coronavirus, the big three cruise companies – Carnival, RCCL and NCL – suffered a debt increase of 90% on a combined basis in 2020 compared with 2019. Credit rating and research firm Moody’s believes it will take until 2023 before they will generate sufficient earnings and free cash flow to materially reduce those debt balances.

As the pandemic rumbles on then, perhaps there is a new question to ask: has the on-board services arms race reached its zenith, or will it continue to boom as cruise lines seek to entice re-bookings like never before?

The demand for big ships

John Zamora is a partner in Deloitte’s transportation, hospitality and services arm. He says the simple answer is that cruise lines will not stop working to build bigger and better ships. “What we see across the sector is not so much an arms race; it’s the industry responding to the demands of leisure travellers,” he says.

“If you look at the growth of cruising over the past ten to 15 years, taking out 2020, it’s grown at a significant pace, grounded in leisure demand. Guests are looking for experiential travel – they want to do different things in one destination – and cruise lines accommodate that need. Cruising also provides a great opportunity for multi-generational travel; when you have these different experiences like rollercoasters, you cater to the entire guest profile of that multi-generational consumer.”

In July 2020, Deloitte released a report entitled Cruises Gonna Cruise, which analysed data from various consumer surveys and found that while cruisers were – understandably – more focused on safety and cleanliness than before the pandemic, their desire to cruise had barely diminished. 86% said that a certification of cleanliness from a trusted authority would make them feel more comfortable as they returned to travel, while booking volumes were increasing month by month.

This trend has continued with Q2 2021 bookings 40-50% higher than Q1, and overall 2022 bookings ahead of those in 2019. “This is the baseline being used to measure recovery and performance and is demonstrative of the resilience of the sector and the demand for cruise companies’ offerings,” Zamora says.

Deloitte’s consumer tracker in June 2021 also showed that 23% of respondents intended to take a cruise in the next three months, up from 14% a year earlier. Amongst cruisers themselves, statistics from CLIA show that 82% are likely to cruise again soon.

Cruising in confidence

Investors, too, have continued to show strong confidence in the cruise sector during the pandemic. “Cruise lines have been able to access capital in the financial markets – it’s been readily available although obviously more expensive,” Zamora says.

Carnival Corporation, for example, has raised approximately $24bn in capital to continue to operate despite a lack of revenue for more than a year and, as well as launching the Mardi Gras, has continued to build other ships, with four more set to debut in 2021 as guest cruise operations resume.

In addition, two more cruise ships are expected to be delivered to Carnival Corporation brands at the end of 2021. Overall, the company has a total of 11 new liners in the pipeline up to 2025.

Two more Excel-class ships are on the way – Carnival Celebration is set to debut in late 2022 from PortMiami and an as-yet-unnamed vessel is scheduled to enter service in 2023.

“Mardi Gras has been a phenomenal success and our ship designers are hard at work planning and outfitting her two sister ships, which we fully expect will generate a comparable response when they set sail in 2022 and 2023,” Clement reveals.

Get your orders in early

Moody’s VP Peter Trombetta says other cruise lines will take similar approaches. “New ships have several benefits for cruise companies and we do not expect that investments will be materially lower in future years,” he stresses. Those benefits, he says, include better fuel efficiency, new technology and better on board experiences, which helps differentiate cruise brands.

23%

The percentage of consumer respondents that intend to take a cruise in the next three months, up from 14% last year.

Deloitte

“Cruising also provides a great opportunity for multi-generational travel; when you have these different experiences like rollercoasters, you cater to the entire guest profile of that multi-generational consumer.”

John Zamora

40% -50%

The percentage rise in cruise bookings in Q2 2021, compared with Q1.

Deloitte

“The amenities and on board experiences also help attract ‘new-to-cruise’ customers which is an important piece of the cruise industry’s growth story,” he adds.

According to CLIA, the new ships that will be introduced in the next few years are predominantly in two segments: exploration/luxury cruise ships and large cruise ships. And while each segment has its drawbacks, those limitations are accepted by their clientele.

“With larger ships, there is an impact on itinerary; they can’t call in as many ports,” Zamora says. “But that is totally consistent with the consumer profile who want to be on those larger ships. What each of these cruise lines are doing – building rollercoasters and Go-Kart tracks – it’s all responding to market demand. Luxury ships are smaller vessels that can manage more ports of call and those customers want longer and deeper itineraries.”

Trombetta’s only word of warning for cruise operators is to place their orders in early to get a place in the queue. According to CLIA, orderbooks typically get filled up seven to ten years in advance.

“If the benefits of the new cruise ships continue to result in higher net yields, orders will continue and it may take longer to take delivery of a new ship eventually,” he says. “There are limited shipyards that can build these large ships, so there is a limit on how many can be built in any given year.”

“Mardi Gras has been a phenomenal success and our ship designers are hard at work planning and outfitting her two sister ships, which we fully expect will generate a comparable response when they set sail in 2022 and 2023.”

Ben Clement

Bigger, better and cleaner

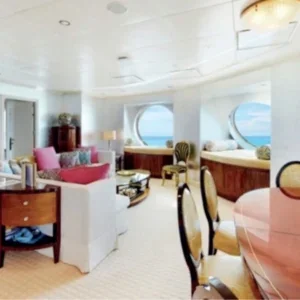

On top of its ‘game-changing’ amenities, which include 22 different dining options, spread across six themed Fun Zones offering ‘mini-on board excursions to different worlds and experiences’, the ship is also one of the most technically advanced and environmentally friendly vessels in the world. It’s the first in the Americas powered by Liquefied Natural Gas (LNG), one of the cleanest burning non-electric fuels available for the cruise industry. Along with its two sister ships, Mardi Gras is among nine Carnival Corporation vessels powered by LNG as part of the company’s ‘green cruising’ platform.

Other technical innovations that have been implemented to reduce the company’s environmental impact include advanced wastewater treatment systems, advanced air quality systems, shore power connection capabilities, and comprehensive waste management, recycling and energy conservation programmes. Again, Carnival is not alone. In September 2020, CLIA revealed that the sector has invested over $23.5bn in ships with new energy-efficient technologies and cleaner fuels. According to Zamora, many ships currently under development will be powered by LNG when they launch, meaning it will take some time for this trend to show up.

Reflecting on the last year and a half, Zamora has been impressed with the cruise sector’s adaptability. “They’ve used it as an opportunity to find operational efficiencies and optimise their business,” he says.

“Moving forward, I believe the industry is going to focus on both [building bigger and better and protecting the environment]. They won’t sacrifice one over the other. They will deliver what the consumer is looking for in terms of amenities and experiences but also reduce environmental impacts by leveraging advancements in ship technology.”

Clement isn’t willing to tip his hat as to what we can expect beyond Mardi Gras’s two sister ships just yet, but no doubt the mission statement will be a bold, expansive one: they’ll be aiming for bigger and better.